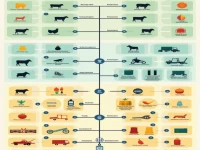

Guide to HS Codes for 54 Blended Synthetic Fiber Fabrics

This article details the HS codes for 54 types of blended synthetic fiber fabrics, including unbleached, bleached, and dyed materials. It aims to assist importers and exporters in easily understanding the relevant standards, optimizing customs procedures, and enhancing efficiency in international trade.